CAPITALIZE Internal Walkthrough...

You may have heard about our new investing newsletter called CAPITALIZE that we're introducing this week with a huge initial launch discount.

We're going to show you what's inside the newsletter as you scroll down below.

First – we want you to understand that it's a brand new, completely different type of investment newsletter that's already producing responses like “Wow, this is far better than I expected” and "I love, love, love this format - can't wait for more."

You’ll understand why … and what this is all about … and even have a chance to jump in and try it yourself by the time you finish reading this short post.

So what makes CAPITALIZE so unique?

Well, first of all, it's not about stock picks.

It’s not about trying to perfectly time when to get in and out of an investment.

And it’s not even about some new kind of investment technique or strategy.

Newsletters with that kind of cookie-cutter information can certainly create some small, short-term investing success...

But they don’t take into account your own unique strengths, Investor DNA or Money Persona...

And they don't produce the kind of radical new insights that you’re about to see — or the kind of paradigm shift that fills you with confidence and puts you in the investment driver's seat…

Or give you the potential for outsized returns that can literally change your family’s financial destiny forever.

You'll see what we mean in just a second when we show you what's inside each newsletter.

Before that, it's important to understand...

How we're going to show you the inside of the newsletter

We really want to show you the newsletter in the most unbiased, non-salesy way so you can see for yourself and make up your own mind.

And since we have an internal, employee-only, Wealth Factory video that already does that, we're going to use that.

You see, Wealth Factory team members have been hearing about this new investing newsletter that's been brewing in our R&D lab for the last couple of months – and they are pretty excited about it.

So to make sure everyone on the team understood what was going on...

The creator and project lead of CAPITALIZE – one of our senior team members named Tom – shared a video with all Wealth Factory employees last week to show them exactly...

- How the CAPITALIZE newsletter is laid out, and

- Why the unique format and content provides such extreme value to our readers.

Now we can't share the actual internal video – but we've grabbed the transcript and annotated notes from the video screenshots so you can see firsthand what a CAPITALIZE newsletter looks like on the inside.

So now you know ...

This is an all-facts, no-fluff (and sometimes raw) look at what you get when you subscribe to CAPITALIZE.

Let's take a look inside...

In the first part of the video, Tom introduces the newsletter this way:

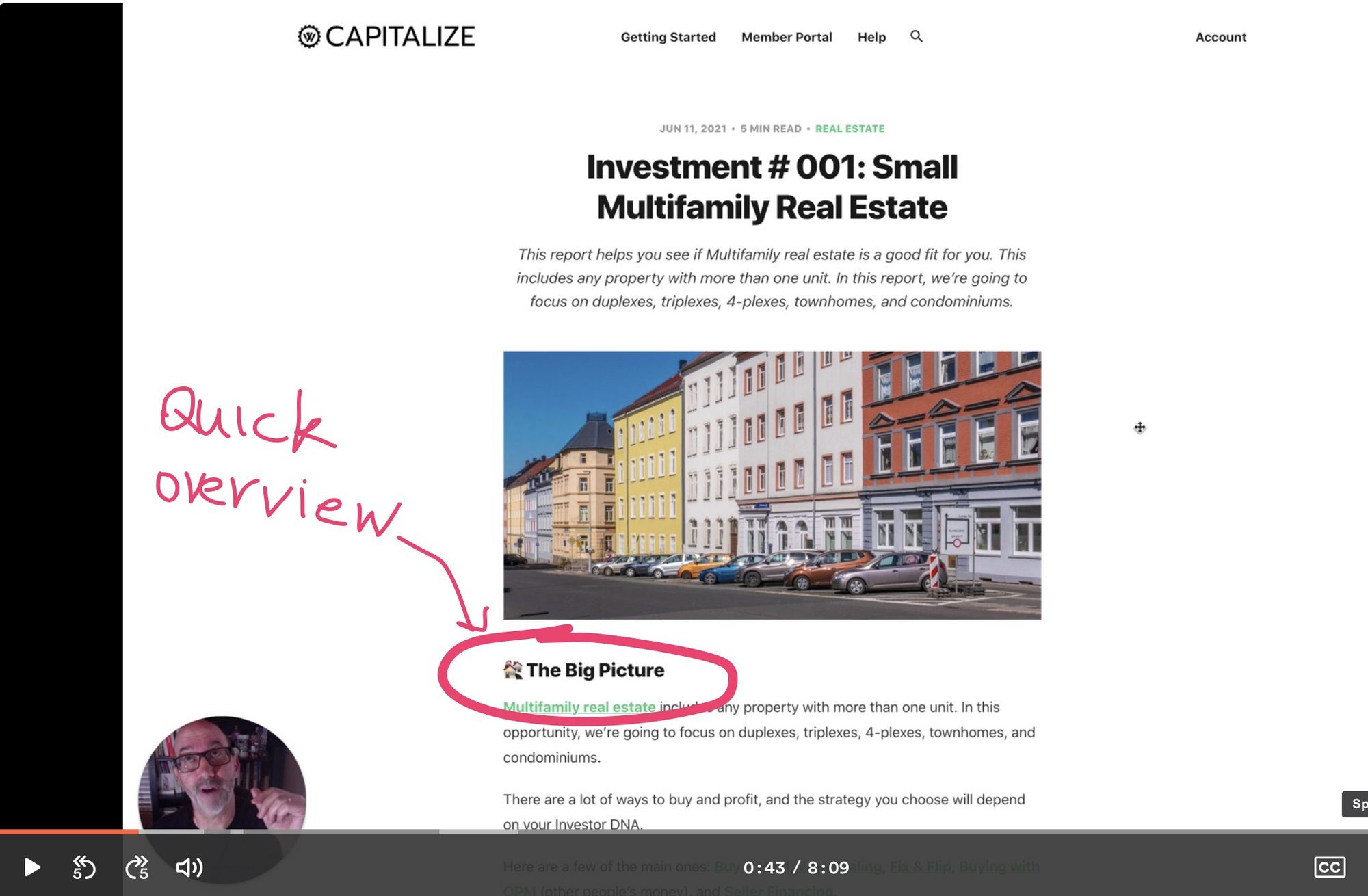

0:36 - So this is what the newsletter looks like on the web. The styling might be a little different in the email version, but the layout is exactly the same. As you can see, there's a title, a brief summary and a picture that captures the essence of the investment. It also shows how long it should take to read at the top next to the date. That's reading without following any of the links. Most of the CAPITALIZE newsletters will be in the 5-7 minute reading time range, which is perfect to get the main gist without too much overwhelm.

0:57 - Now the first heading you'll see is The Big Picture which just gives a real quick overview of what to expect with this particular investment idea. You'll notice that there are a ton of links, and I'll talk about that a little bit later, because if you want to dive deeper and follow all the links, you can really go down the rabbit hole and become very knowledgeable about this investment in a single weekend. And because we curate all the sources, you can just click through each link one by one and it saves you at least 7-8 hours of research to find all this info. So that's a huge benefit to the reader.

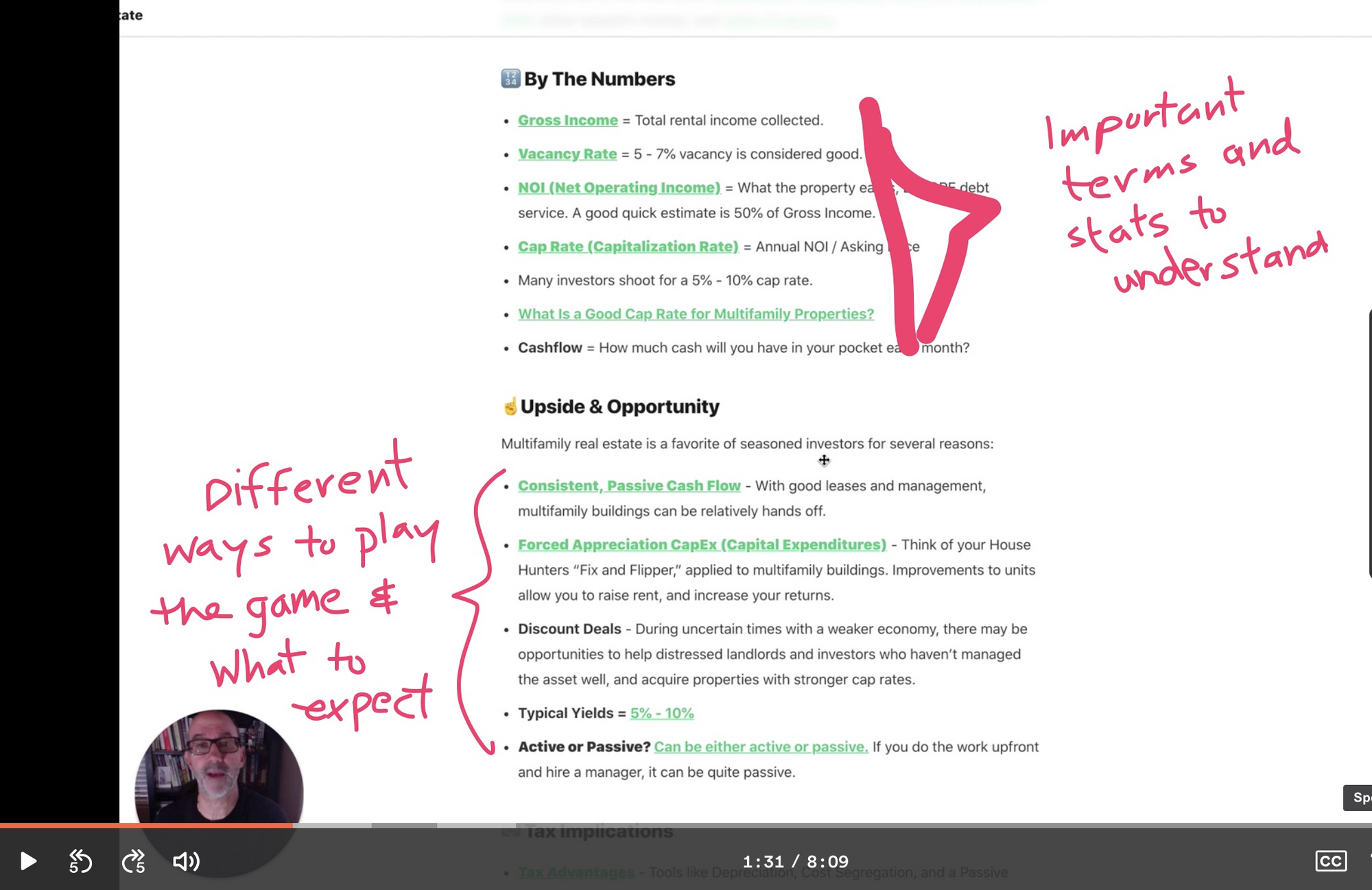

1:11 - The next heading you see is By the Numbers and this section has a bunch of the important statistics and numbers that people need to know when they're looking into this particular investment. In this case for Multifamily Real Estate, we give links to things like vacancy rate, gross income, net operating income, cap rate, and all kinds of different jargon that comes into play and that you need to understand when you're looking at investing in multifamily properties.

1:30 - The next section is Upside and Opportunity. Here we talk about some of the different things you should be looking for with this particular investment and some of the different ways you can structure your investment – or "play the game" as we like to sometimes say, which simply means there may be different strategies that suit different styles of investing or that provide different yields or ways to get paid. And we also have a section on exit considerations and how active or passive you can expect this investment opportunity to be.

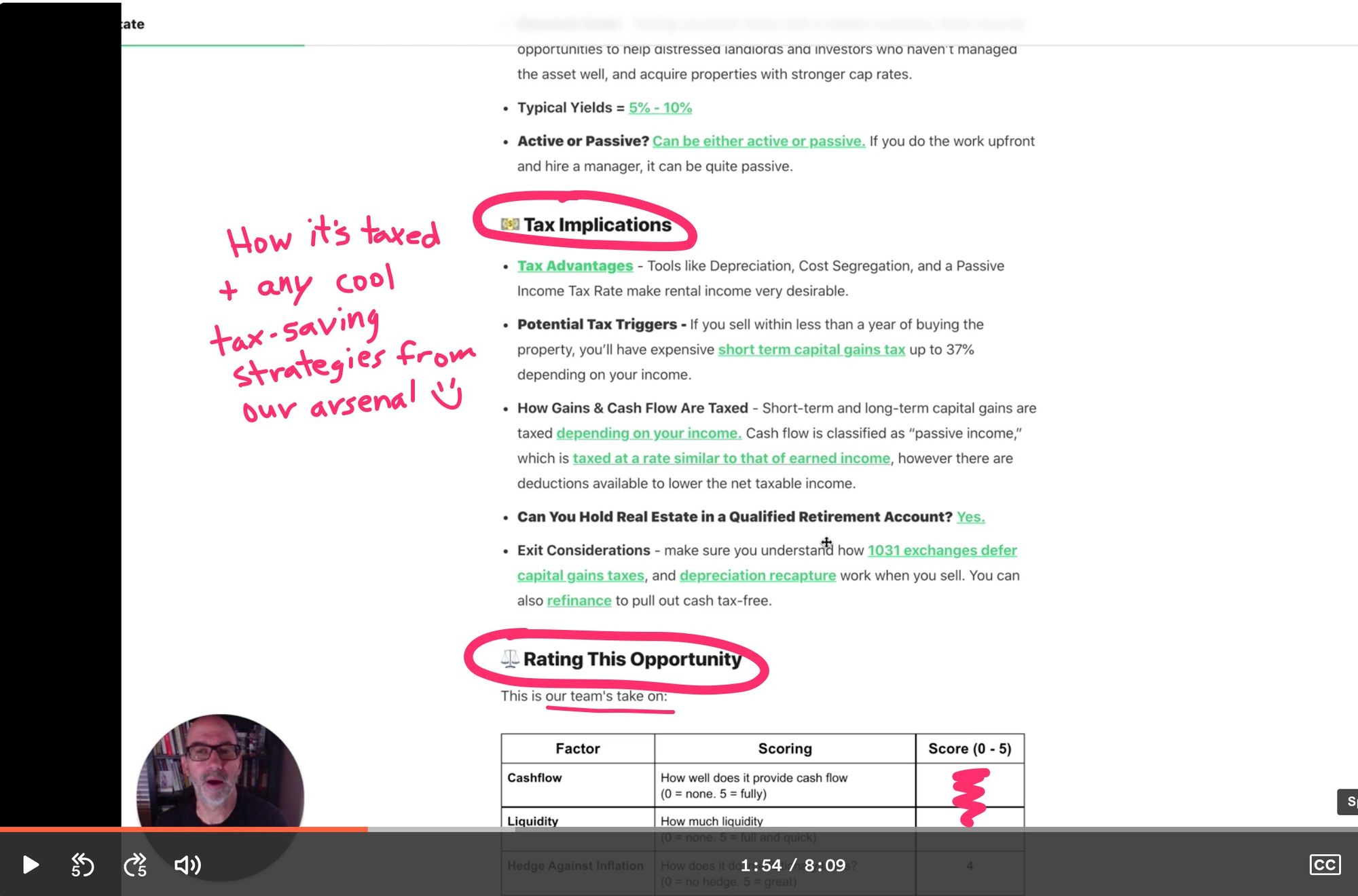

1:56 - The next section is called Tax implications where we talk about how this investment is taxed, any special tax hits to be aware of – and then we can also share any cool tax-saving strategies that we have in our vast arsenal that may apply to this investment. Next up is the Rating the Opportunity section. This is a chance for our research team to weigh in on several very important metrics – for example, what we believe the cashflow potential is, how much liquidity it provides, how well it hedges against inflation, how much inherent risk is involved.

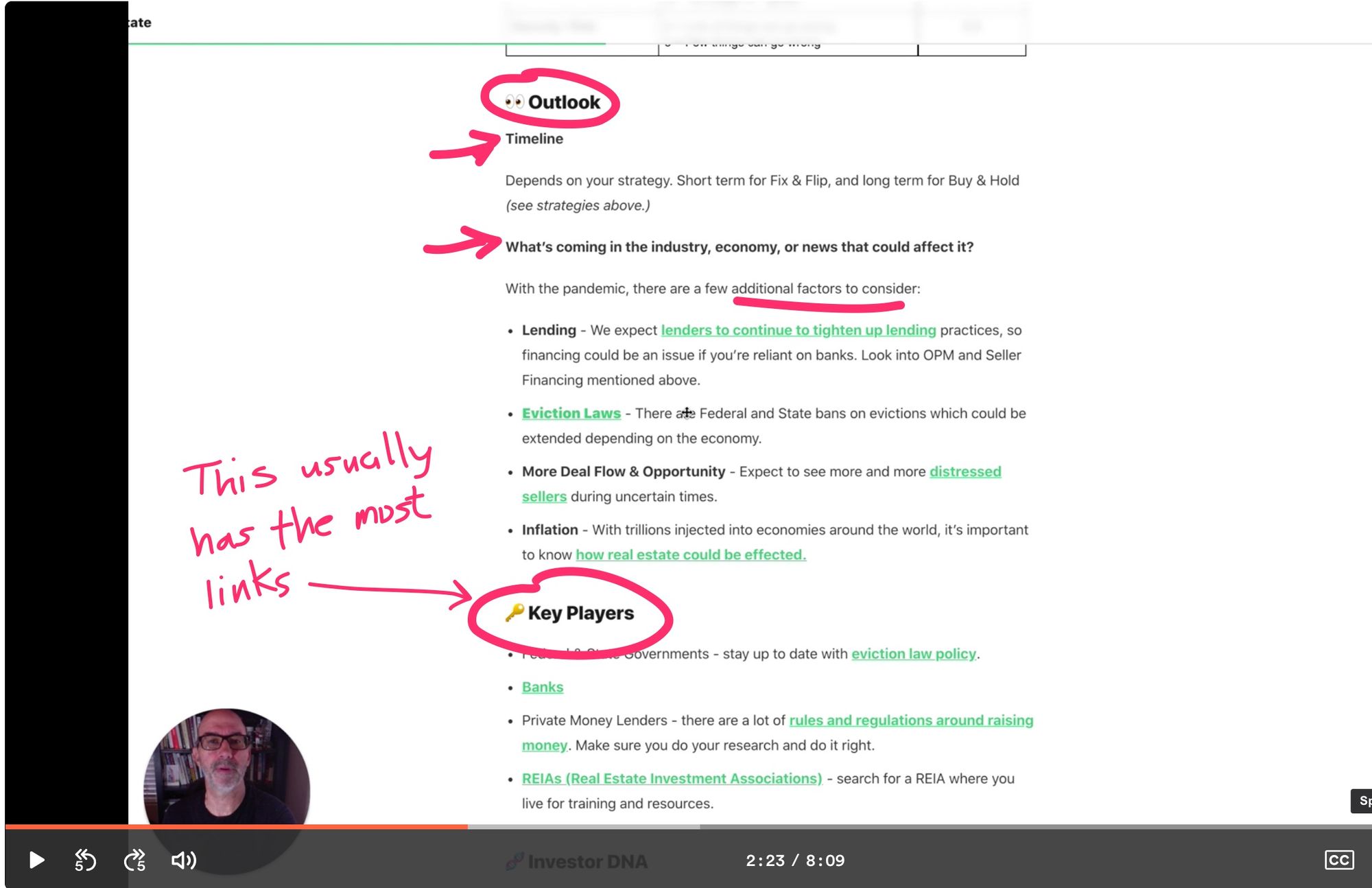

2:22 - The next two headings are called Outlook, and the Key Players. The Outlook section gives what an investment timeline might look like, what's coming up in the industry, and anything else that may affect this investment in the short or long term.

2:40 - The Key Players section is usually one of the biggest sections, with the longest list of links. But it depends on the investment. In this particular issue it's, it's fairly short because real estate investment associations are primarily going to be very local. So we just give a link so that they can find the one that's local to via zipcode. But in most of the issues that we are researching right now, this Key Player section has a very long list of links. And you'll see that when you get some of the future issues on things like Stablecoins, and Luxury Watches and Airbnb Arbitrage...

3:03 - So the next section is called Investor DNA, and this is what makes this newsletter so unique –and really it's a gamechanger when it comes to investing because risk is in the investor, not the investment.

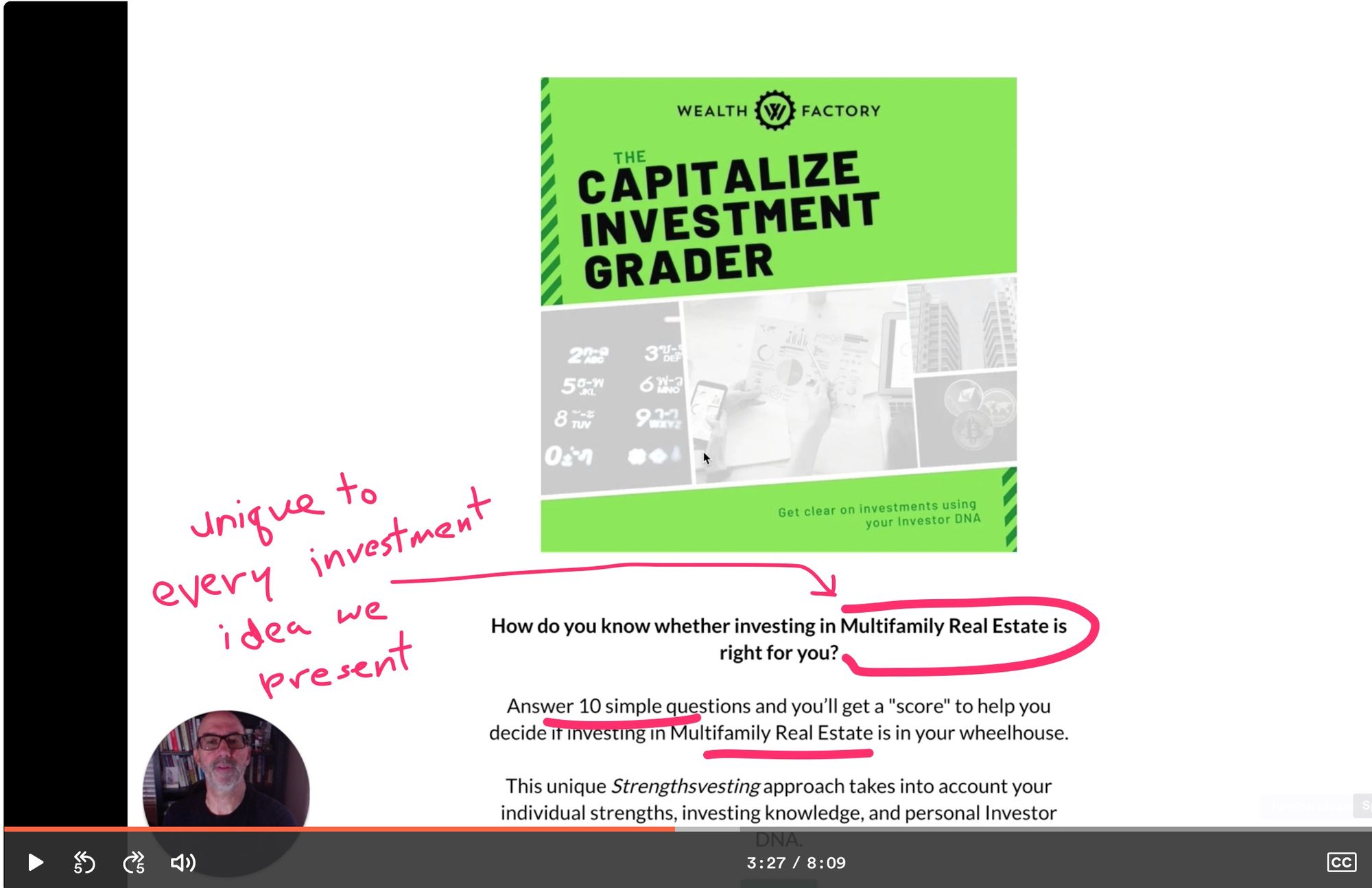

3:13 - So this is pretty cool. We've built this tool called the Capitalize Investment Grader, and I'm just going to click on that and see if that pulls up what I want...

And there it goes. So what it does, in this particular case, it asks "how do you know whether investing in multifamily real estate is right for you?"

3:31 - And what happens is there is a button here at the bottom that starts it up, and they answer, 10 questions, specifically about Multifamily Real Estate investing and then it gives them a grade. It's a grade that gives an indication of how well the investment fits them right now. So that's a great way for anybody to see whether or not this is an investment fits their current strengths. Now a low number doesn't mean they can't pursue this. It just means they will need to do more learning and research before they actually invest money, as long as it fits the rest of their Investor DNA. This is one of the sections that makes our newsletter unique from all other investing newsletters. The primary question to ask before you invest is not "how much money can I make?" – but "how well does this investment fit my Investor DNA or Money Persona?" Because when you focus on that, then a kind of magical thing that happens where, it positions you to actually make the most. So it's a little counterintuitive to what most people like to think.

4:51 - So the next section we have is Risk, which includes the known risks of this particular investment, keys to managing that risk, and things to watch out for. This is another very important section, that I believe totally differentiates us. Because knowing how to identify and manage risk is the key to not losing money.

You've heard Warren Buffett say that investing rule #1 is to not lose money. And rule #2 is to follow rule #1 – or something like that. Well, managing risk is the key to not losing money. It's so important, yet most people skip it because they're too focused on the "making money" part. And that's a mistake – so we want to make people better investors, remember.

5:02 - So the next section, Everything That Could Go Wrong, fits right into that. We don't want anyone to jump into any investment without knowing all the different things that could go wrong. And there are some pretty crazy horror stories we share. Not to scare people off, but to make them aware of all potential risks.

5:19 - And related to that, as we research, we find some people who really hate an investment or are big critics. We don't dwell on that, but we always share at least one opposing view so readers can see all the sides of this investment.

This is about doing critical thinking, which is key to becoming a great investor, but not really promoted in the investment newsletter industry. So the key thing is we're not rah-rahing any particular investment. We want to see all sides. So we bring in haters and critics to at least give one other voice or viewpoint to what's going on here.

5:29 - Then the last section is we give a bunch of Resources, which includes a bunch of links to online resources, books, trade publications, magazines, podcasts and even Pros & Courses Teaching This, etc

5:35 - So that's basically the newsletter, and as you can see here from the timer on the video, it's a five-minute read when you just kind of scan through it like we did. And that's great for getting a nice general overview of the investment idea. But as you can imagine, if you clicked on all these links and went in, you could really go deep and can become as big of an expert as you want.

5:50 - So the idea of this newsletter is to help people go wide first – and then deep if they want.

In other words, we bring them a bunch of different investing ideas we're researching that they've probably never heard of or considered.

Then we give them a quick way to review the investment and learn the basics. This will actually make them a more knowledgeable and well-rounded investor on its own.

So we are never suggesting that people invest in every single one of these ideas. Just the opposite. Like I said, we help them go wide first so they can find maybe 6-10 ideas that really intrigue them throughout the year. And then as they research and match up their investor DNA on that small subset, they may only invest in one or two.

But once they do decide to invest, they'll be totally prepared and fully focused. That's what great investors do – and that's what we want for our readers.

And one big thing that I think we need to really talk about is that we're not pretending that we are somehow investing experts in each of these areas. We are researchers. We are providing in-depth, curated research and then presenting it in a way that doesn't overwhelm the person who isn't interested – but still gives them a working knowledge.

And we give the person who is interested enough material to go as deep as they want. So we're, of course, super excited about this. Our research team, we've already learned so much ourselves and have had so many "aha" moments just creating this. So we're kind of doing this for ourselves too – and our own family members. And that's why we are really excited to introduce this to our Wealth Factory members in the next week or so.

So that's what this is all about – directly from our team leader who created CAPITALIZE.

As you see, our goal is to help you be the best investor you can be by focusing on what you're good at and uncovering the ideal alternative investment that fits your Investor DNA.

CAPITALIZE does it all on a weekly basis, and our first group of subscribers agrees. Look below to see what a few of them are saying about how much they love CAPITALIZE.

If you'd like to join them, you can get in on the initial CAPITALIZE launch and lock in your introductory pricing until Monday, June 21, 2021:

See Your CAPITALIZE Introductory Discount Offer Here

Build the life you love,

The Builders at Wealth Factory

P.S. Still not sure if CAPITALIZE is all it's cracked up to be?

Here's what a few new CAPITALIZE subscribers told us:

Wow! So much more detail than I was expecting! I like that you've stacked up pros and cons for different investor mindsets and situations so I can decide quickly if this is something worth investigating right now (or not). Then you've put together such a huge amount of curated resources to dive deeper and learn more! Great format, can't wait til next week. Thank you!

-Larissa R.

WOW!! This is comprehensive research. I am impressed with the depth, detail and links to more information.

-Kim D.

I love, love, love the format, explanations, and links. Send me everything you have on real estate & green energy!

-Ryan Z.

LOVED THIS! Short and sweet. To the point. BUT VERY THOROUGH. Loved the extra resources.

- Linda M

I love the layout. It is so organized and love the bite-size chunks of info. The format is great for my reader A,D,D lol. Awesome info too! Thank you!

-Stephen N.

This is Fantastic!!!!!!!! I can't wait to hear about Crypto!

-Merry L.

WOW, what a great simple way of hitting all the main points and adding a plethora of resources. This short read gives me just enough to know if I want to dig deeper and then enough info to go as deep as I want. Can't wait to dig deeper!

-Coralyn W.

I absolutely love your debut topic of Multi family investing. Capitalize is very informative and packed with excellent information. The additional links everywhere are great, I can click to another article or learning source for the information I am unfamiliar with or most interested in. You look at the investment topic from so many different angles and provide lots of information and value in a direct detailed format. Keep up the great work!

-Koren W.