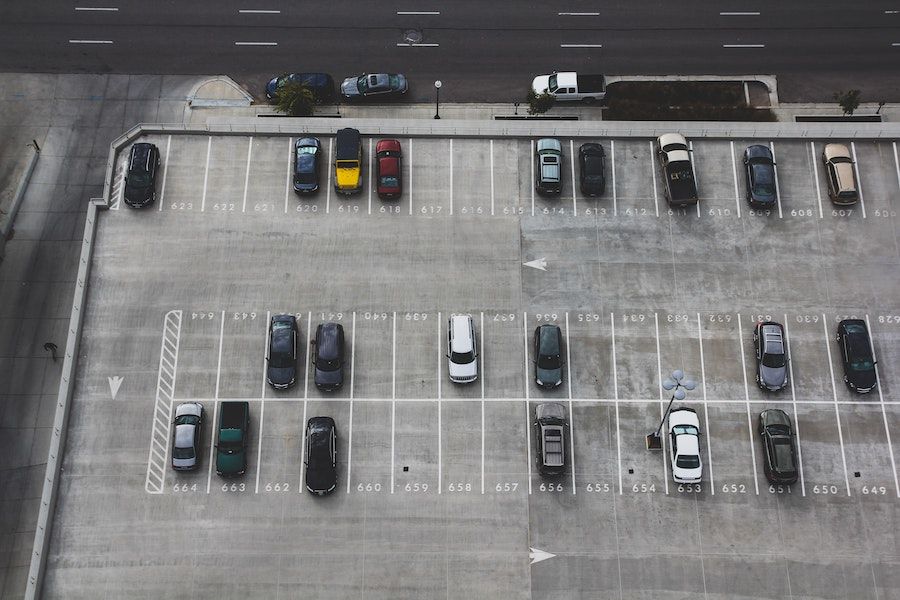

Playbook #045: Parking Lots

🖼️ The Big Picture

Like the idea of passive monthly income from real estate, but don’t want to deal with tenants?

Parking lots, garages, and spaces (yes, you can buy a single space) are a unique niche investment that doesn’t get a lot of attention, but if bought well, could take good care of you for a long time with regular cash flow.

Yes, you’ll still have to deal with expenses like taxes and insurance. And sure, there will be some maintenance if there’s cracked cement. But as far as real estate goes, it’s pretty far on the “passive and simple” side of the spectrum.

While there are strong returns available, you definitely need to be careful with this one. Land, in general, is illiquid and takes much longer to sell compared to other asset classes. So you want to approach this as if you're in it for the long haul.

With that in mind, you need to be very certain about the business model and clientele for the lot. Is it government employees? Startup office workers? A nightclub lot that’s empty during the day and jammed full at night? Or maybe a spot for truck drivers?

Like any retail store, you need to know your customer. Drive by the lot at different times of day to note how busy it is, and figure out what drives traffic to it. You can find 2 different lots within a few blocks, where one is a winner… and the other a complete loser.

However, if you do strong due diligence, negotiate a great deal, and understand how to optimize the business model, you could find yourself an excellent passive investment.

🔢 By The Numbers

You don't have access to this CAPITALIZE issue at the moment, but if you upgrade your account you'll be able to see the whole thing, as well as all the other posts in the archive! Subscribing will give you immediate access.

This CAPITALIZE issue is for members only

Join nowWhat is CAPITALIZE?

CAPITALIZE is a tool for discovering new ways to grow your wealth. You get a new investment idea each week in a simple 7-Minute report. Quickly check to see if it matches your "Investor DNA" and fast-track your way to being a top 1% investor... with less risk. Created by Wealth Factory for people who want to build their wealth and keep it.