Playbook #059: Options - Selling (Naked) Puts

🖼️ The Big Picture

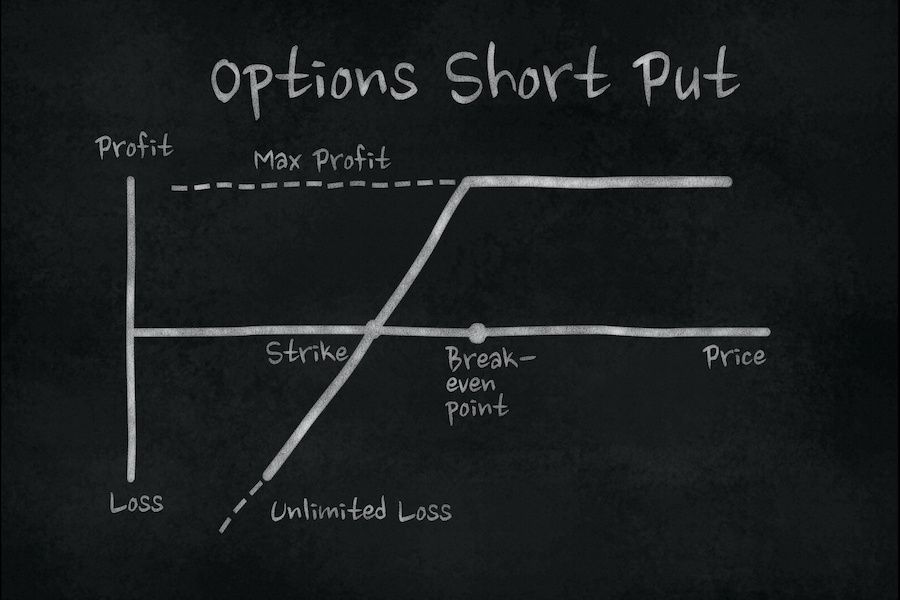

Selling PUT options is a stock trading strategy for creating cash flow during a neutral or bullish market. It can be done by novices or advanced options traders with certain adjustments. Professional traders prefer selling naked put options using a margin account. This allows them to create 30%-80% returns on their money under the right circumstances.

If you have some experience trading, or if you’ve read our previous issues on options, there are exit strategies you can employ so that even if you lose, you’ll have a way to get back to profit.

Selling a PUT option means you’re selling an options contract on a specific stock (always for 100 shares) to a buyer that gives them the right - but not the obligation - to sell 100 shares to you for a strike price with a specified expiration date… for a premium.

As the seller of the PUT option, you are essentially selling "insurance" to the holder of a particular stock.

If the underlying stock price falls below the strike price anytime before the option expires, the buyer of the PUT option can exercise the option. This is like them making an insurance claim — and forces you to buy their share at the strike price.

Why would you do that? Well, just like insurance companies make a lot of money selling insurance, you can also make a lot of money selling stock insurance via PUT options.

You see, if the price of the underlying stock doesn't go below the option strike price by the expiration date, the option contract expires. That means you keep the premium that was initially paid out with no further obligation.

The buyer of your options contract wouldn’t exercise it because they would be selling you shares at less than market value for the stocks (and losing money).

So why would someone buy the PUT options you are selling?

Two reasons:

- If the buyer of your PUT contract owns shares of the underlying stock, they are likely buying insurance in case the price goes down.

- They might also just be "traders" who believe the price of the stock will go down — so they are making a bet that they can buy your contract now at your price — and sell it later at a higher price for a profit if the price of the stock goes down.

Naked or Covered?

If you sell a PUT on a stock you don't own, it is called a Naked PUT. If you already own the stock, it is called a Covered PUT — since you would just give up your existing shares in case the uyer exercised their option.

A Covered PUT has the same exact risk profile of a Covered Call trade, which we covered in a previous issue of CAPITALIZE.

A Naked PUT requires a margin account and uses leverage to "borrow" share from their broker as collateral. If the counterparty buyer exercises, you will be required to buy shares at the current market price to satisfy their right.

Professional traders like to sell naked PUTs, and (especially when a stock is on an upward trend) can make a lot of money collecting premiums for the insurance they provide.

Here’s an example of how this works in action:

You’re feeling bullish about InGen (let's say they just released an announcement of a new dinosaur), so you decide to sell some naked puts on them, because you don’t believe the stock price will drop much, if at all, in the month. Here’s the scenario:

- It’s August 1st, and stocks are currently trading at $20 per share.

- Your brokerage account lists the market price for PUT options expiring Oct 20th.

- The strike price is at $19 per share (meaning when you sell the put option, you’re obligated to buy stock at $19 per share if the buyer of your option contract exercises it).

- The option premium that you’ll collect when you sell this contract is $1 per stock

- Options contracts are for 100 stocks, so you’ll sell 1 naked PUT option contract and receive $100 immediately. This is your premium, and maximum profit.

- It’s a “naked” put because you don’t have an existing position on the underlying stock. This means you’ll need to qualify for a margin account with your broker.

- Your "break even" point is $18 per share ($19 strike price - $1 premium). As long as the stock price stays above $18 before expiration, you will still be "in the black" on the trade.

If the stock stays above $19, you win and keep the entire $100 option premium.

If the stock dives, you’ll be forced to buy back the PUT option. You can do this anytime before the expiration date, although if the stock price falls a lot, you will be paying more to buy it back than you sold it for.

If the stock price dips below $19 per share at expiration and you have sold your PUT option, the stock will be "assigned" to you and you'll be forced to buy it at the agreed upon strike price.

For example, if the price goes down to $15, then you’ll have to buy 100 shares — now worth only $1,500 — for $1,900. Here’s the math:

- Your option premium was $100 (revenue).

- You spent $1,900 to buy the shares (expense).

- Your shares are worth $1,500.

- From a cash flow perspective, you’re out of pocket $1,800 ($1,900 to buy the shares less the $100 option premium you collected).

- But you still own shares of a company you’re bullish on for $1,500… meaning you lost $300 on paper in this trade.

- The safest way to play this is if your Investor DNA aligns with stock trading, and you understand the fundamentals of this stock well, because even if you lose on the option, you still own stock that you believe in.

At this point, you could execute a “married put” trade, which we featured in a previous CAPITALIZE issue here.

- You're other options include:

- sell the stock immediately and accept your $300 loss

- Hold on to the stock until the price goes back above your break-even point

- Write covered calls against the stock as a short or long-term cash-flow strategy and then sell the stock later

Successful investors create cash flow with this strategy by selling many PUT options per month. The closer the expiration date, the higher the probability that the option will expire worthless, and you’ll keep your premium. However, because it’s less risk for you (and more for the buyer), it also means your premium will be less expensive (meaning less cash flow for you).

Many traders find selling PUT options with an expiration date about 3 months away with a strike price near or a little below the current selling price gives the best balance of a healthy premium while maintaining a good chance that they will not have to buy the stock.

This is a game of analysis and probability that can create excellent cash flow for the right investor.

🔢 By The Numbers

You don't have access to this CAPITALIZE issue at the moment, but if you upgrade your account you'll be able to see the whole thing, as well as all the other posts in the archive! Subscribing will give you immediate access.

This CAPITALIZE issue is for members only

Join nowWhat is CAPITALIZE?

CAPITALIZE is a tool for discovering new ways to grow your wealth. You get a new investment idea each week in a simple 7-Minute report. Quickly check to see if it matches your "Investor DNA" and fast-track your way to being a top 1% investor... with less risk. Created by Wealth Factory for people who want to build their wealth and keep it.