Playbook #100: Mexican Zero-Coupon Bonds

🖼️ The Big Picture

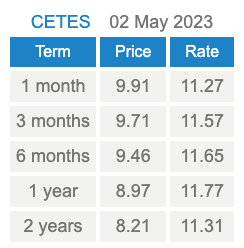

The latest Mexican CETES rates can be found on their government website here

Welcome to our first international issue of CAPITALIZE. To date, every opportunity we’ve revealed has been U.S. focused. That’s been intentional because investing out of the country adds additional layers of complexity and risk for most investors. However, a unique opportunity to earn strong returns by investing in our neighbor to the south has come to our attention, and if you’re comfortable with things like exchange rates and foreign investments, this could be an interesting fit for you.

In previous issues, we’ve explored different types of bonds, including municipal bonds, corporate bonds, and U.S. Government TIPS. The concept is relatively simple: purchasing a bond essentially loans money to the issuer, who pays a set return for a set period of time.

As the investor, you can hold the bond to maturity, at which time the issuer pays you back. Or you can sell it on the open market; however, prices fluctuate with interest rates and other factors.

The reason this international bond caught our attention is because of the availability for high returns with an extremely short term. Here’s the scoop:

Just like the U.S. Federal Government issues Treasury Bills (a bond guaranteed by the U.S. government which is considered to be “riskless”)... other governments around the world do the same. The strength of the country, including its economy and currency, dictates the terms of the bonds issued.

It’s a little under the radar, but recently, some savvy U.S. investors have been buying Mexico’s equivalent of the U.S. T-Bills.

These Mexican Federal Treasury Certificates are known as CETES (Certificados de la Tesoreria de la Federación), and they’re issued as Zero-Coupon Bonds by the Federal Government and the Bank of Mexico (Mexico’s central bank).

These are actually a lot more simple than other kinds of bonds, and get this… as of the time of writing, you can lock in your money for just 1 month - guaranteed by the Mexican government - for an 11.27% annual return. Intriguing, right? But before you go whipping out your checkbook, there are a few things you need to know:

- Zero-Coupon Bonds do NOT pay interest. Instead, they’re bought at a discount from their “face value” and profits are paid out at the maturity date.

- The bonds are issued in Mexican Pesos, not U.S. dollars.

- They are investment-grade bonds backed by the Mexican government; however, there is still risk.

- If you believe the credit rating agencies like Moody’s (they were exposed as being “directly influenced by the demands of the powerful investment banking clients who issued the securities and paid Moody’s to rate them,” in the aftermath of 2008 recession and they rated Silicon Valley Bank as “A” right before it collapsed… so their accuracy is debatable)... Mexico’s bonds are rated BBB as of their last update in 2022.

In this issue, we’ll cover more of the details of how these interesting foreign bonds work and discuss the risks and benefits. Whether you feel this could be a fit for you or not, we encourage you to read this issue in full because it’ll give you valuable insight into how you need to think about investing outside of your home country (and continue to help you dial in your Investor DNA).

🔢 By The Numbers

You don't have access to this CAPITALIZE issue at the moment, but if you upgrade your account you'll be able to see the whole thing, as well as all the other posts in the archive! Subscribing will give you immediate access.

This CAPITALIZE issue is for members only

Join nowWhat is CAPITALIZE?

CAPITALIZE is a tool for discovering new ways to grow your wealth. You get a new investment idea each week in a simple 7-Minute report. Quickly check to see if it matches your "Investor DNA" and fast-track your way to being a top 1% investor... with less risk. Created by Wealth Factory for people who want to build their wealth and keep it.